PayPal Credit Promotional Payment Allocation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PayPal Credit is using fraudulent deceptive practices when allocating payments towards promotional purchases. In 2015 CFPB ordered them to pay 25 million to its consumers for their shady practices. It’s 2018 and not much has changed. I have 24 month promotions and I have 6 month promotions. I make my minimum payment towards my 24 month promotions. And I payoff my 6 month promotions way before the end date. Most within a month of the purchase date. BUT PayPal Credit has this deceptive payment hierarchy where they allocate your payments so they benefit from accrued interest. So even when you make the minimum monthly payment and make extra payments to pay off your 6 month promotions, PayPal is not applying your extra payments towards the 6 month promotions. You have to call and ask to have your payments allocated towards the promotions or you’ll get stuck paying what I call the “stupid tax” 19.99% interest from the date of purchase. They bank on consumers lack of knowledge. They never communicate this in writing. They only tell you this when you call and complain. Extremely fraudulent deceptive practices. Shame on PayPal.

- Labels:

-

PayPal Credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

**bleep** YOU PAYPAL AND SYNCHRONY.

I'LL NEVER USE YOUR SERVICES AGAIN AFTER PAYING MY BALANCE OFF.

THIS IS OUTRAGEOUS AND THE FACT I HAVE TO CALL EVERY SINGLE MONTH TO ALLOCATE MY OWN PAYMENTS IS EXTREMELY ANNOYING - AND AS IF I HAVE ALL THIS TIME IN MY HANDS.

**bleep** YOU AGAIN FOR NOT LISTENING TO YOUR CUSTOMERS AND STOPPING THESE SHADY PRACTICES. **bleep** YOU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I feel your sentiment nycjimmy 😕

I used to use PayPal and PayPal Credit for so many years, almost exclusively, for big purchases...until Synchrony Bank ****'ed it all up.

Haven't used it since I paid my ransom to get away from these terrible practices. How is this legal? Well, quite possibly some de-regulation that happened in the past few years has made this legal again. And we're the ones to pay the price...the money is one thing, but the MADNESS of talking to these people once a month and being promised things and lied to and the disappointment again and again...that is time we just can't back...they are time-thieves, which is one of the worst thieveries there is...because time is Life!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have the same problem as most everyone else! I have a 24 month easy pay and several 6 months no interest. Every single month I have to call to have my payments allocated to the 6 month purchases or all of it goes to the easy pay. So, when I call and ask they always wait for one to 2 billing cycles to make the change just so they can get the extra interest accrued. This seems so illegal and I know that they have been sued for similar practices. They do think we are stupid. Like someone else said...why can't they just make a check box as to where we want the payment allocated. I am able to do this with several other credit accounts so I know that it is not to difficult to do. Sure, Paypal is an easy way to pay for online purchases and I have never let things get to the point where I am paying interest, but I am paying everything off on this account and although, I am not going to close it, I am not going to use it for interest free purchases. They make a lot of money off the sellers when we buy things using PayPal, too bad that just isn't good enough for them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have similar situation but it worked ok. I am in UK, what I have always done is paid extra in period between payment being taken and next bill generated. All payments from monthly minimum are allocated correctly and the extra paid before next bill is issued is allocated to the 4/6 month items.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have tested the following and this will hopefully serve as a guide for others:

- Any overpayment made within 2 billing cycles to an interest free (2, 3 or 6 month) promotion expiring will be applied to those balances. No need to call in and apply the payment. Example. Your 6 month promotion expires on Oct 10, 2020. Your statement period is Aug 18-Sep 17, 2020. For your Sep payment, anything you pay over the minimum due will be applied to the 6 month promotion (first bill cycle Sep 2020, second bill cycle Oct 2020), until you pay that promotion plan off.

- If you want to apply a payment to an interest-free balance 3 billing cycles or more in advance of the expiration, you must call and ask for a supervisor (if you want it done correctly). The supervisor can do this using any payment method you have listed in paypal credit.

- The PP Credit portal will show (1-2 days later) that the payment was applied to the next expiring 12 or 24 month plan

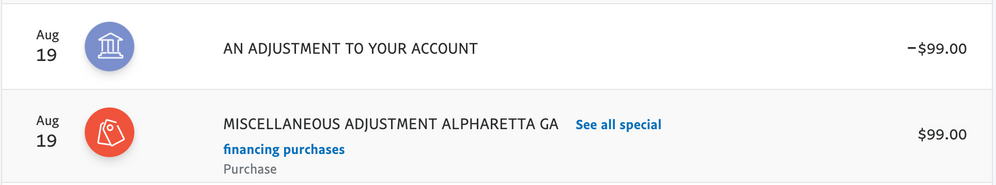

- In approximately 2 weeks, you will find an "adjustment transaction" on the portal and on your statement that moves the payment made in step 2 and applies it to the correct balance. Note that in this picture, the adjustment occurred on Aug 19, but the phone payment was made on Aug 8

- You may receive an email stating the allocation was made, but it will take another day or two for the portal to reflect the adjustment. I have just set a calendar event for 2 weeks to check the portal

The way to get this fixed is to continue to call in to allocate your payments. I have been told by the supervisor that this is a system issue related to having easy pay balances and same as cash promotional balances. Until enough people start calling in to work around this system issue, PayPal Credit is not going to change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

So are you saying that if I have two months left to pay on my 6 month interest free purchase I am already up the creek without a paddle? I knew I had to pay $81 a month to pay off my 6 month plan but all that got messed up when I did a 24 month plan with a really expensive purchase two months ago. Now instead of having $162 left to pay on my 6 month plan I have over $260 left to pay. On my 24 month purchase it now says I have 18 payments left instead of 22.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@jgatl , I just want to make sure I understood your last post. I have a minimum payment of $61.94 due on 12/3/2020. My 6 month is up on 1/3/2021. My 24 easy pay is due in 2022. So if I am now in that two month window for my 6 month no interest and setup an auto payment of $167.94, will it allocate $33.94 to my 24 easy payments and $134 to my 6 month or do I still have to call in to have them allocate the money correctly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

@jgatl as long as they apply the extra payment to my 6 month I will be fine. If they don't then I will call in. The 6 month was a $432 purchase. I paid $28 the first month. Then I knew I had to pay $81 for the remaining 5 months. When I got to the third month I then had the 24 easy payments for another purchase. I finally realized the problem this week, after I had already paid 4 months on the 6 month and 2 on the 24. Going forward I don't think I will ever have more than one financed purchase at a time. Time is precious to me and I don't want to be wasting time talking to someone on the phone.

The 24 month purchase I made I originally tried to get financed through Affirm which is offered through the company that actually makes the product. They said you could qualify for 0%. I filled out the application and they came back with 17%. I was like, you gotta be joking. My wife and I are double 800 credit scores. So I found the product on eBay and was more than happy to pay 5.99% which is pretty darn good. So I am not going to complain about how PayPal Credit does their creative banking. They offer a really good interest rate compared to other companies.

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.

- Ebay purchase canceled and refunded. Instalmen but Plan payment still being taken 2 months later in Products & Services Archives

- PayPal Credit how is interest accrued after Promotional offers If not paid in full. in Products & Services Archives

- How to allocate a payment towards an interest free purchase in Products & Services Archives

- Promotional offer not being cleared by payments in Products & Services Archives

- current balance, promotional offers in Products & Services Archives