Paypal "Minimum Payment Due" SCAM!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

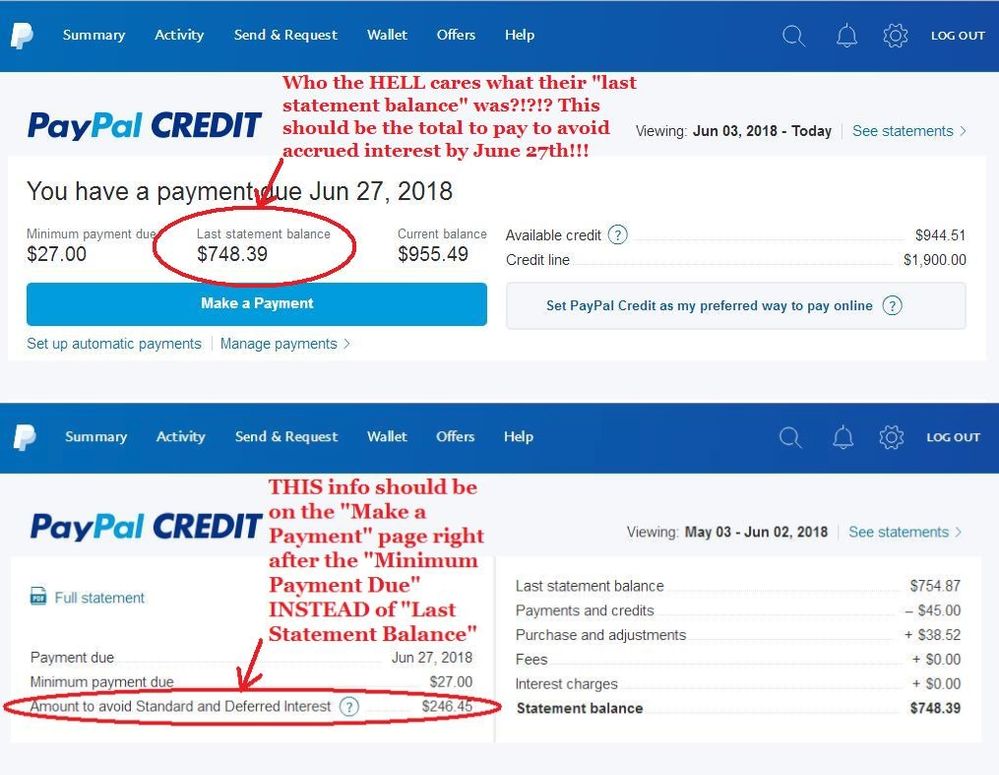

When you click on "Make a Payment" on the Paypal site you are brought to the make a payment page, and it doesn't show the "Amount to Avoid Accrued and Deferred Interest" after the "Minimum Payment Due". Instead the show the **bleep** "Last Statement Balance" total, instead of the amount due to avoid the accrued interest, WHO THE **bleep** CARES WHAT YOUR LAST STATEMENT BALANCE WAS?!?!?! This is the "Make a Payment" page, the thing directly to the right of the "Minimum Due" amount NEEDS TO BE the "Amount to Avoid Accrued and Deferred Interest", but the SCAM ARTISTS here at Paypal are hoping you see the minimum amount due and pay it instead of paying off the total amount so they can charge you the interest.

I sent them this message in an email and I will be contacting my attorney in the morning regarding a class action lawsuit... "While making a Paypal Credit payment it is RIDICULOUS that when you go to "Make a Payment" on the Paypal Credit page it shows in the top left hand corner "Minimum Payment Due" with the amount below it, and directly to the right of that is "Last statement balance". WHO THE HELL CARES WHAT THEIR LAST STATEMENT BALANCE WAS ON THE MAKE A PAYMENT PAGE?!?!?!? What SHOULD BE THERE is "Amount to Avoid Standard and Deferred Interest", but it is obvious this is INTENTIONALLY not being shown in hopes that members using Paypal Credit only pay the minimum due so that Paypal can then charge the interest accrued.

I will be contacting my lawyer regarding a class action lawsuit due to intentional misrepresentation of the payment due instead of showing the amount needed to avoid the accrued interest. This is an obvious scam, it is clear to anyone with half a brain that the amount needed to be paid to avoid the accrued interest should be clearly posted right next to the minimum amount due on the "Make a Payment" page, none of us should have to click on or search for that info on another page, and I will gladly see you in court when this case is filed with the NJ attorney general's office. There is no excuse for this deception."

- Labels:

-

Billing and Payments

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Thanks for the head's up. this is a scam. If you make "minimum payment due" from the account info page or on the reminder email without accessing looking carefully at your statement for this other amount, it will prompt the application of interest on your promotional offers. Could easily be fixed by posting the MIN PYMT DUE TO AVOID INTEREST right in the account/payment info on the website or in payment reminder email. Also, if you make excess payments, as I always do, and don't read the fine print on how they apply these to the amounts that are due LATER (not the ones coming due sooner), you can also end up not paying off the amounts by the promotional date despite making significant payments. These practices make it virtually impossible to set up auto payments in advance to ensure meeting the terms of interest-free financing. They could easily remedy this application by clicking on the an option of how you want payments applied to the promotional balances. I am going to pay off my PP credit and close my account. Too much hassle to avoid charges and fees now, which negates the convenience of using PP credit in the first place.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i have been paying my smart connect account for over 1 year strait, Not even using the account.every month i pay at least the minimum of $200.00 per month...And last i checked it was around $3200.00 in August, 2019. As i said monthly payments i make at minimum $200.00 a month. some months $400.00, even $700.00, just to get the balance down, (I THOUGHT)! well today April 22 2020, i decided to see how my account was doing? Thinking with my big monthly payments and almost 9 months have gone by of those payments. I was thinking I should be down to almost $0 of a balance by now...

Boy was I wrong, over the last 9 months I HAVE PAID my PAYPAL SMART CONNECT account over $3900.00, (mind you- I have not even made a single purchase on this "smart connect account" since May 2019.... Well to my astonishment and surprise my PAYPAL SMART CONNECT BALANCE is at $2489.95..... Back 9 months ago my SMART CONNECT account was at about $3000.00..

Is this not rediculous, NOT 1 late payment... NOT 1 purchase on this account in over 1 year... I started with about a $3000.00 Balance i owed them, spent the last 9 months making prompt on time OVER payments,(sometimes 2 payments a month), I payed them over $3900.00 in 9 months and still owe the[Removed. Phone #s not permitted]00 i paid in the last 9 months, ONLY took $505.00 off of My PAYPAL BALANCE...UNREAL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Their plan is to make it easy to miss one of their triggers and hit you with the deferred interest.

They are not out to help you, they want to hook you up into the milking machine.

If they can't get you early they increase your credit hoping to snare you.

When that fails to get you that's when they really begin the dirty game.

I made a call to allocate payments to pay off the to "special financing purchases" that where coming due in the next 3 months.

That should have dropped the amount to avoid pretty low. Nope the statement that showed up 7 days later shows another large sum due to avoid.

When I called to get more details about the breakdown of the "amount to avoid" BS I was told a more definitive statement was not available.

The amount of standard purchases I've made over the last 15 months is a smaller total than this amount on the new statement.

I don't have the time or experience to dig into their Bernie Madoff schemes. I will pay these guys off and hit the door.

You only win this one by not playing in the first place.

I get that consumer banks are not known for good ethics and when MARQUETTE NAT. BANK v. FIRST OF OMAHA CORP.(1978) cracked open the vault the rats smelled the cheese and it was only a matter of time before these methods of usury became the American way.

What a legacy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.

- Paypal ask payment method twice in My Money Archives

- Payment in My Money Archives

- I can’t use pay pal as a payment method on my ps5, any ideas? Please help in My Money Archives

- i cant make a purchase online using paypal in My Money Archives

- PayPal took money from my account because buyers card issuer took it in Payments Archives